Case Study

SKKY Hotel

Long-term revenue, operations, and positioning support for a 32-room boutique hotel in Whitehorse — building disciplined pricing, steadier decision-making, and repeatable systems that hold up through volatility.

Executive Summary

Outcomes

- RevPAR improvement (2011 → 2023): +69%+

- ADR improvement (2011 → 2023): ~+62%

- Transformed the hotel from “treading water” to a stable market leader with repeatable systems and clear accountability

- TripAdvisor Travellers’ Choice recipient in multiple years, including 2024 (the only hotel in Whitehorse to achieve this distinction)

Privacy note: This case study focuses on performance and momentum using percentage changes and trend outcomes rather than publishing proprietary rate or revenue values.

What changed

- Introduced clearer rate architecture and steadier yield habits to reduce reactive discounting

- Built repeatable reporting rhythms (pace, pickup, segmentation) to improve decision confidence

- Strengthened corporate and group contracting with firmer terms and cleaner controls

- Improved distribution, direct booking fundamentals, and reputation systems without adding operational strain

Context

SKKY Hotel is a 32-room boutique hotel in Whitehorse, Yukon, serving a market shaped by mining activity, seasonal tourism, and emerging winter demand. The property includes a small restaurant space and a meeting room, and operates with the constraints typical of lean, independent hotels.

The building began as a 1970s motel and was extensively renovated when SKKY launched in 2008. By 2011, the hotel had early traction but was performing below its potential. Ownership engaged Four Sides Hospitality Consulting to bring more discipline to revenue decisions, strengthen operational systems, and support a sustainable operating model.

Whitehorse is a city of roughly 25,000, positioned as a northern gateway close to Alaska. Demand is influenced by mining (gold, silver, copper), exploration activity, summer road travel to Alaska, and international visitation (including European and growing Asia-Pacific winter segments). The competitive set is led by a small number of dominant hotels backed by larger ownership groups, alongside a handful of independents and a rental-pool hybrid competitor.

SKKY remained operational through periods of high disruption — including 2020–2021 — while several competitors closed temporarily and at least one shut down permanently. Performance recovered beyond pre-disruption levels, supporting reinvestment into the property.

Performance trend (high level)

The long view matters in markets like Whitehorse. When demand shifts quickly, the goal is not simply “higher rates” — it’s better decision quality: clear thresholds, fewer emotional moves, and steady habits that compound.

Long-term momentum

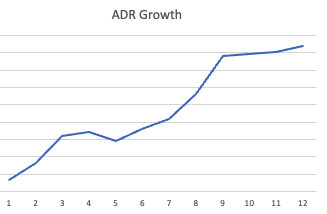

- ADR: up +82.7% since 2014 (rate strength built over time)

- RevPAR: up +73.2% since 2014 (pricing discipline + demand capture)

- Resilience: maintained ADR discipline through the 2020–2021 disruption and re-accelerated post-recovery

How we talk about results

- We share changes and outcomes using percent movement and trend direction

- We avoid publishing proprietary rate or revenue values

- We focus on the operating logic behind the outcome: structure, cadence, and accountability

Objectives

- Build pricing discipline aligned with the hotel’s positioning in a small, competitive market

- Reduce reactive decision-making through clearer reporting and pace visibility

- Strengthen negotiated rate strategy (corporate, government, groups) with enforceable terms

- Support operational clarity across front desk, distribution, and guest recovery

- Improve review volume, response cadence, and conversion confidence over time

Scope of Work

- Rate architecture, seasonal strategy, and channel positioning

- Forecasting, pickup tracking, segmentation, and pace reporting

- Corporate and group contracting, RFP support, and term enforcement

- Distribution oversight (CRS / OTAs), cost awareness, and merchandising

- Front desk systems, booking practices, SOP guidance, and training

- Reputation management systems and guest feedback workflows

Key Decisions and Interventions

Rate structure rebuilt for clarity and resilience

Observed: Early pricing lacked consistent logic across seasons, segments, and channels, which created unnecessary volatility and margin pressure.

Changed: Implemented a clearer rate ladder (RACK, corporate, government, tactical offers) supported by pace visibility and defined thresholds.

Why it mattered: Better decision quality, fewer last-minute reversals, and stronger outcomes without constant intervention.

Negotiated business brought under firm terms

Observed: Corporate and group rates were inconsistent, often under-priced relative to market value, and lacked enforceable controls.

Changed: Formalized rate agreements, improved renewal discipline, and negotiated tighter operational terms (deadlines, rooming list controls, late/short-notice guardrails where appropriate).

Why it mattered: Protected rate integrity while staying competitive in a market where negotiated demand can distort pricing if unmanaged.

Distribution and reputation systems made repeatable

Observed: Direct booking performance and review cadence required more structure to support long-term compounding gains.

Changed: Strengthened booking-path fundamentals, introduced consistent post-stay feedback prompts, and standardized response practices.

Why it mattered: Improved conversion confidence and visibility while keeping workload realistic for a lean team.

Results

2025 vs 2024 (full-year snapshot)

- ADR: +4.8% year over year

- RevPAR: +2.3% year over year

- Occupancy: -1.9 pts year over year

This is the story we like: even when occupancy softens, disciplined pricing and distribution keep revenue quality strong. It protects margin, limits volatility, and creates capacity for reinvestment.

What that reflects operationally

- Fewer reactive moves during soft patches; clearer thresholds for action

- More consistent merchandising and channel discipline during peak demand

- Stronger contract controls so negotiated business supports (not dilutes) pricing strategy

- Reliable reporting cadence so ownership decisions are anchored in pace, not noise

Selected 2025 monthly movement (vs 2024)

Below is a percent/points view only. Late-year months are often affected by timing and year-end finalization, so this is best read as directional movement rather than a standalone verdict.

| Month | Occ (pts) | ADR (%) | RevPAR (%) |

|---|---|---|---|

| January | -9.9 | +10.4% | -4.4% |

| February | -3.7 | +4.6% | -0.3% |

| March | +8.7 | +4.8% | +16.5% |

| April | +19.3 | +7.2% | +39.8% |

| May | +14.5 | -1.8% | +18.7% |

| June | +1.3 | +1.2% | +2.7% |

| July | +2.4 | +2.8% | +5.4% |

| August | +2.0 | +3.5% | +5.8% |

| September | -2.7 | +3.1% | +0.3% |

| October | +1.5 | +3.9% | +5.8% |

| November | -20.2 | +8.8% | -21.1% |

| December | -31.9 | +6.3% | -44.3% |

If you’d like, I can also rewrite this table as an index chart (e.g., 2024 = 100) so it reads more like a story: “rate quality held,” “peak outperformed,” “off-season pressure,” etc — still without publishing proprietary values.

Current Position (as of 2025)

SKKY is positioned as a dependable boutique option in Whitehorse, with pricing discipline, channel oversight, and operating habits that can be maintained through seasonal swings. The hotel has built a track record of performing through volatility — not by chasing every short-term move, but by strengthening the fundamentals that hold.

The practical win is sustainability: decisions are clearer, thresholds are understood, and performance momentum is supported without adding complexity the team can’t carry.

Explore partnership options

If you’re building steadier revenue decisions and calmer operations in a competitive market, we can help you put the right structure in place — without adding unnecessary complexity.

Long-term consulting engagement with a 32-room boutique hotel in a competitive market.

- Transformed the hotel from a struggling operation to a market leader, achieving record-setting performance year over year.

- Increased RevPAR by over 69% and boosted ADR by approximately 62% from 2011 to 2023, with projections for further growth in 2024.

- Secured TripAdvisor Travellers Choice awards in multiple years, including 2024 - the only hotel in Whitehorse to achieve this distinction.

- Provided comprehensive guidance in revenue management, operational efficiency, and market positioning in a dynamic economic environment influenced by mining, tourism, and emerging industries.

- Demonstrated versatility by successfully managing various aspects of hotel operations, including revenue, sales, and front desk management.

The SKKY Hotel is a boutique hotel located in Whitehorse, Yukon. It is a small hotel, only 32 rooms (which includes 3 suites), a small restaurant space, and a small meeting room in the basement. The original building was built in the 1970s, operating as a motel. When SKKY Hotel was formed in 2008, the structure was heavily renovated with basically the entire hotel being gutted. Everything was replaced in the hotel: floor, bathroom, bedroom furniture, and more.

Four Sides Hospitality Consulting started working with them in April 2011.

At the time we were contacted, the hotel had been in full operation for only a few years. The growth was there, but the hotel was well below where it should have been performing. We were contacted to help guide the hotel to the next level and help make it more of sustainable operation instead of treading water. Apart from a minor slip in 2013 due to a downtown in an unexpected dip in the economy and the pandemic years of 2020-2021, the hotel has been setting records on an annual basis. The hotel overcame the challenges faced with the pandemic, remained open throughout while several competitor hotels closed for periods and one permanently shutdown. Revenues are currently well-above pre-pandemic levels, which is allowing the ownership group to re-invest money into the hotel for future improvements.

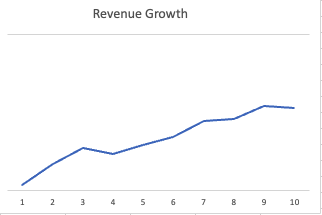

With the charts above, Year 1 is the year prior to the SKKY Hotel working with Four Sides Hospitality Consulting. Year 11 and 12 are the pandemic years, which caused the revenues to crash, but the ADR continued to grow.

Whitehorse is a city of 25,000 located in northern Canada, close to Alaska. The main economic force is mining activity (gold, silver, copper primarily) but natural gas exploration is also starting to occur more. In the summer time, tourism takes over with visitors travelling to Alaska by car or European tourists taking advantage of a direct flight from Frankfurt, Germany. Winter tourism is slowly growing with guests from Japan, Korea, and Australia.

In terms of the hotels in Whitehorse, the city is dominated by five main hotels. A Best Western, and another small boutique hotel are owned by a large development partnership. A Quality Inn and an independent hotel are owned by another large development firm that owns close to 50 hotels in Canada. The other main competitor is an independent hotel/vacation rental property with independent owners putting units into a rental pool. There are several other large and small hotels that are rated no higher than 2.5 stars.

Throughout the blog here, I have written about some of the things we have corrected, improvements made, and also highlighted are successful years. The first section is below, written after the first year.

May was the end of the first full year I had been working with a boutique hotel as a hotel consultant. I did a very thorough review of the year in a blog post, Year-End Review: Boutique Hotel, but I will include a few more details about it here. The boutique hotel is small, under 40 rooms, in a remote city. It is also a new hotel having only been in operation since 2009. The local economy is based upon mining and exploration activity happening in the area, as well as tourism in the summer time. Winter tourism is minimal, but is slowly gaining traction as the Asian markets look for alternatives to Vancouver/Whistler, Calgary/Banff. The hotel has a leased restaurant space, but no other amenities that you would find in a larger hotel in most of Canada (no fitness room, business centre, sauna/hot tub, pool, or elevator). Regardless of the lack of these amenities, the hotel is gaining in popularity with the locals and is ranked 4.5 stars on TripAdvisor.

They first approached me in April 2011 to get guidance with their revenue management as the summer season approached, but have extended my contract based upon the successes it had during the summer, and have increased my responsibilities to help out in other areas of the operation.

Year One Results

Here are the results for revenue growth (click to expand):

Overall, revenue has been up 6.4%, ADR has been up 5.9%. I’m pleased with the result, but know there are improvements to be made. I was rather disappointed in how November and December performed, and really disappointed in April. November-January are historically the worst months of the year, so I was going into the months with the aim to at least match the year before. I go into detail in the blog post about the problems faced during those months.

If I take out the three down months, the revenues increased 9.2%, which shows how disappointing those three months truly are.

Changes Made

There are quite a few things that were changed that are impossible to track completely, but here’s a short list of actions I initiated:

- New rate structure with higher rates overall (RACK, Corporate, Government)

- New CRS to increase hotel exposure and capture higher paying guests

- Tweaks to roomMaster 2000 to improve how the agents take bookings.

- Tweaks to the website to improve search rankings, with plans to release new website after the summer.

- Formalize contracts with companies with negotiated rates, have one controlled source for rates instead of multiple people.

- Slowly increase advertising expenditures in smart ways (targeted magazines, ads on certain community radio stations).

- Implement guest satisfaction survey that is automatically sent to guests after a stay.

- Track revenues for pace reports.

- Create and implement marketing plan for longterm growth.

- Smart negotiation with companies.

Company Contracts

The last point has been an important one. One of the major issues with the hotel was how they handled negotiated rates with companies and groups. The companies had rate structures which were very low in comparison to the RACK rates, and didn't match each other. The hotel stayed away from group business completely, which is very lucrative in the city and can be very beneficial. Bus groups generally arrive late in the afternoon, and check out early morning, allowing the housekeeping staff to work right away without delays during the day while waiting for people to check out. Plus they tend to stay on site and eat in the restaurant, which helps keep the restaurant busy on slower nights.

When the contract came up for re-negotiation in the fall with one of the companies, I was put in charge of it. Here is what happened:

- Agreed to rate increase of nearly 10%

- Agreed to late fee worth 70% of room rate

- Agreed to firm deadline for room schedule, addition/subtraction

With the late fee factored in, their room rates effectively increased by 82%.

Other company contracts were renewed for higher rates, and new ones were won with competitive rates without completely sandbagging them in comparison to the competition. Being competitive with these RFPs for corporate rates can be tricky, but the hotel is coming out on the winning end more often than not now. New group business was also found as companies were looking to switch away from the other hotels in the city. If things go well in the coming season, the group business will only increase as word of mouth spreads with the operators.

The CRS

The company I went with was InnLink (now owned by Sabre). There were four factors that helped push me in their direction:

- The startup costs were minuscule in comparison to SynXis and TravelClick.

- The layout of the booking engine was exceptional in my opinion compared to most hotel booking sites.

- The backend was easy to navigate and offered a lot of flexibility to control what I needed to control.

- It interfaced with the hotel’s PMS, which no additional fees to set it up.

The switch worked wonderfully, and the new CRS has been producing over 20% of the hotel’s revenues. The percentage is even higher in the off-season, which is when the hotel needs the bookings the most. The ADRs have been exceptional, as well. Even taken into account the bookings coming from Expedia and other OTAs, the ADRs are outperforming the hotel staff. If interested in learning more about InnLink, get in touch with the sales rep I link to on the Resources Page.

Advertising & Social Media

Before I started, the hotel did no advertising in the previous year. They did some when the hotel first opened, but none in the following year as there was a change in management. The social media presence was minimal, as well, with only a very inactive Facebook page. I started the process of finding some favourable advertising locations, and developed the advertising myself (copy and artwork) and had some positive results. The main campaign targeted the outlying communities that traveled to the city to do shopping, medical appointments, etc. In the winter time, people tend to make extended trips to avoid traveling long distances in the cold temperatures. We ran the campaign towards the start of the off-season and saw locals stay 10-15% more than they did the previous year. We plan to run a similar campaign in the next off-season.

Other advertising has been placed in business magazines for the area and a directory of supplemental services to the mining industry. The latter advertisement was just published, but the advertisement stands out from the competition with its size and content. We plan on following up with the companies listed in the directory to do a direct mailing campaign, and will be attending more conferences related to mining activities in the near future.

Social media campaigns have fallen flat, due to the lack of activity in the region. To give you an idea, the main competition has 250 followers on Facebook, this hotel is a hundred under that. By comparison, the hotel near me in Kelowna has 600 followers, and it's a small hotel. This is something I would like to improve upon, but it will be a slow moving process. I did redesign the Facebook page to a custom one which helps the hotel stand out from the competition. Engagement is starting to increase as we enter the summer season. I am interested to see how it fares throughout the rest of the summer.

2012 Projections

Based upon the value of the company contracts, this year is going to be excellent in terms of revenue and ADR growth. Even with the slip-up in April, the summer season is looking to increase by 10%. The company contracts bleed over into the off-season, which will help that revenue base. The off-season should increase by at least 10% itself, with the overall increase being between 12–16%.

Things to look forward to:

- New website with improved SEO

- Better yield management strategies with roomMaster 2000

- An effective advertising campaign through the year.

- Reliable, loyal, well-trained staff.

- Stronger social media presence.